The global regenerative medicine market is rapidly advancing, characterized by groundbreaking techniques. These techniques involve adipose-derived stem cells, microfat, bone marrow aspirate, and platelet-rich plasma and focus especially on verticals in orthobiologics, aesthetics, reconstructive surgery, and wound healing. These revolutionary treatments are available for conditions including osteoarthritis, joint pain, and sports injuries, and as biological fillers for the aesthetic reconstructive industry. This burgeoning field stands at the forefront of medical science but also presents a lucrative avenue for investors seeking to capitalize on cutting-edge healthcare innovations.

Understanding Regenerative Medicine

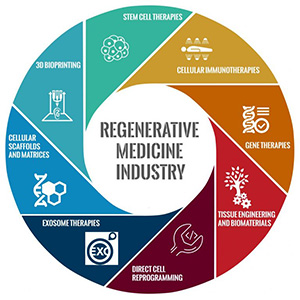

Regenerative medicine encompasses a variety of applications that restore or establish normal function by replacing damaged or diseased cells, tissues, or organs. Techniques such as adipose-derived stem cells and microfat grafting are notable for their efficacy and minimal invasiveness. This makes them highly appealing for both patients and practitioners within orthopedic treatments, sports medicine, aesthetics, and reconstructive surgery.

Global Regenerative Medicine Market Growth and Potential

The global regenerative medicine market is experiencing a surge. This is driven by increasing demand for innovative treatment modalities and enhanced health care technologies. We value the 2023 market at approximately $28 billion and project it to grow to over $81 billion by 2030. This will achieve a compound annual growth rate (CAGR) of 15.9% during the forecast period. An aging population, the rising prevalence of chronic and degenerative diseases, and significant advancements in biotechnology fuel this robust growth.

Investment Opportunities

Investors looking to enter the regenerative medicine market can find numerous opportunities across various sectors and stages. These include:

- Product Development: Investing in companies that are developing new regenerative products, like adipose-derived therapies and microfat-based treatments, which are increasingly used in managing joint pain, enhancing recovery in sports medicine, and as biological fillers in the aesthetics industry.

- Global Expansion: Along with huge markets in the US and EU, the market is expanding globally. There are significant opportunities in emerging markets, particularly in Asia-Pacific, Middle east, and South America. These markets are expected to witness the highest growth due to rapidly improving healthcare infrastructure and increasing medical tourism.

- Technological Innovations: Funding technological advancements in technologies such as stem cell therapy and tissue bioprinting are pivotal for maintaining the momentum of market growth and treatment efficacy.

- Collaborative Ventures: Joining forces with established biotech firms through direct investments or venture capital can provide a strategic advantage in navigating the complex regulatory and technological landscape of regenerative medicine.

- Market Stage and Verticals: There are dynamic pre-market companies developing new products and technologies, in-market and post regulatory approval companies, and medical practices. Additionally, there are companies in supporting roles such as distribution and marketing. Further, there are opportunities in verticals such as sports medicine, joint pain and osteoarthritis, aesthetics, reconstructive surgery, and wound healing.

Conclusion

The rising global market for regenerative medicine offers hope in the form of advanced therapies. It also presents a fertile ground for robust investment returns. Early adopters of these investment opportunities position themselves to reap significant benefits, aligning financial gains with transformative health outcomes.

For those interested in the future of healthcare, regenerative medicine offers a beacon of progress and profitability. We will continue to explore this dynamic field in upcoming posts, focusing on specific geographic markets and clinical applications. The potential for informed investment grows ever clearer.